What is the CAN SLIM Strategy?

A proven methodology for identifying high-growth stocks.

Introduction

Overview

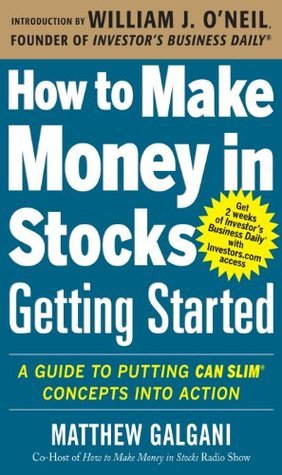

William J. O'Neil's seminal work, How to Make Money in Stocks , first published in 1988, remains a cornerstone in the world of stock investment. This book not only introduces readers to the CAN SLIM strategy but also provides a comprehensive guide on how to identify top-performing stocks in any market condition. Updated multiple times, the book reflects the evolving nature of stock markets, making it a timeless resource for both novice and seasoned investors.

Objective

The core objective of this resource is to delve into the CAN SLIM strategy, as articulated by O'Neil, and explore its application in modern-day stock investment.

This approach is tailored for a diverse audience, ranging from beginners who are new to the stock market to seasoned investors looking for a systematic approach to optimize their portfolios.

The Foundation of The Calculator

canslimcalculator.com

Explore the power of the free CAN SLIM Calculator, an advanced tool to analyze stocks and support investment decisions. Built on the proven canslim methodology, this custom algorithm evaluates each criterion from the canslim strategy. It ensures your stock picks align with the top-performing canslim stocks. The tool simplifies stock analysis, making it accessible to both seasoned investors and beginners. Whether applying the canslim method or seeking a reliable investment strategy, this platform offers a powerful, user-friendly resource. Use the free stock calculator to enhance your portfolio and achieve your financial goals.

Big Rock #1: Market in Confirmed Uptrend

Main Content

Introduction to the Investment Strategy

CAN SLIM is an acronym representing seven key factors identified by O'Neil as essential for high-growth stock identification. This strategy merges technical and fundamental analysis to create a solid framework for evaluating potential stock investments. Originating in the 1950s, CAN SLIM has evolved over decades, remaining a valuable tool for investors aiming to outperform the market.

-

Current Earnings: Strong, recent earnings growth is vital.

-

Annual Earnings: Consistent, long-term growth is crucial.

-

New Products, Services, or Management: Innovation and leadership drive stock performance.

-

Supply and Demand: Market trends and stock availability are key.

-

Leader or Laggard: Invest in leaders, avoid laggards.

-

Institutional Sponsorship: Favor stocks with strong institutional backing.

-

Market Direction: Align investments with overall market trends.

Analysis and Critiques

Advantages of the Strategy

The CAN SLIM strategy combines both technical and fundamental analysis, providing a balanced approach to stock investment. Its clear criteria allow investors to make informed decisions, and its proven track record demonstrates its reliability. Compared to other strategies, CAN SLIM offers a structured, methodical approach to identifying high-potential stocks, which can help mitigate the risks associated with investing.

Disadvantages and Risks

While CAN SLIM has its strengths, it also comes with certain limitations:

- Requires Experience/ Technical Knowledge: The strategy is not suitable for all investors. Successful application requires a solid understanding of technical analysis and experience in stock market investing.

- Not Ideal for Bear Markets: CAN SLIM is primarily designed for identifying opportunities in a bullish market and may not be as effective during a bear market or periods of significant market downturn.

- High Monitoring and Trading Costs: The strategy demands continuous monitoring of both the market and individual stocks, potentially leading to higher trading costs.

- Market Volatility Impact: The performance of CAN SLIM can be significantly affected by market volatility and economic downturns, particularly if investments are not aligned with the overall market direction.

Conclusion

Summary of Key Points

The CAN SLIM strategy offers a methodical approach to stock investment, combining both technical and fundamental analysis to identify high-growth stocks. It emphasizes the importance of market direction, earnings growth, innovation, and institutional support, providing a reliable framework for making informed investment decisions.

Final Recommendations

The CAN SLIM strategy is ideal for investors seeking a systematic approach to stock investment. To maximize success, it is recommended that investors continue their education through further reading, financial courses, and active participation in investment communities. Regularly reviewing and adjusting your strategy based on market conditions will help you stay ahead and achieve consistent returns.

Additional Information

Frequently Asked Questions

what is the canslim method?

The CAN SLIM method is an investment strategy developed by William J. O'Neil. It is designed to help investors identify high-growth stocks by focusing on seven key criteria: Current Earnings, Annual Earnings, New Products or Services, Supply and Demand, Leadership, Institutional Sponsorship, and Market Direction.

I’ve created this as a FREE tool just for you!

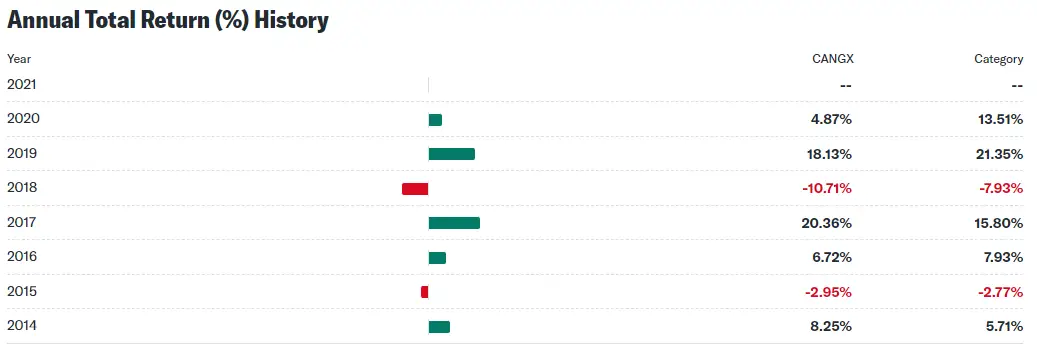

what is the average return on canslim?

The average return on CAN SLIM varies depending on market conditions and the investor's skill. Historically, disciplined investors have often outperformed the market using this strategy.

Is CANSLIM value investing?

No, CANSLIM is primarily a growth investing strategy, focusing on stocks with strong earnings growth rather than undervalued stocks.

Learn more about value investing and stocks with strong earnings.

what is the best book on canslim?

The best book on CANSLIM is "How to Make Money in Stocks" by William J. O'Neil. This book offers a comprehensive guide to understanding and applying the CANSLIM principles in stock market investing.